From The Executive Director......

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: November 14, 2025

RE: The FY 2026 Government Shutdown Ended

The longest government shutdown in U.S. history has ended after the House passed, and the President signed into law, a Senate spending bill funding the government (CR-Continuing Resolution) but not addressing the Affordable Care Act (ACA) subsidies that were the source of the shutdown.

Older Americans Act (OAA) and other aging programs are funded until January 30, 2026, as is Medicare Improvements for Patients and Providers Act (MIPPA).

The bill also fully funds the Supplemental Nutrition Assistance Program (SNAP) through September 30, 2026. SNAP lapsed for the first time on November 1, leaving food banks and state governments scrambling to meet hunger needs of SNAP beneficiaries. Area Agencies on Aging may expect to see funds four to six weeks after the passage of the CR (according to national estimates. ECIAAA will continue to monitor and provide updates.

Thank you for your ongoing advocacy for the Older Americans Act (OAA) – to keep the discussion going, please directly contact your U.S. Congressional representatives and sharing personal stories about the impact of OAA services.

Send a Letter to Your Congressman/Congresswoman

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: October 31, 2025

RE: SNAP (Supplemental Nutrition Assistance Program) Benefits End November 1, 2025

As the government shutdown continues, the U.S. Department of Agriculture (USDA) announced that it will not use its contingency reserves SNAP benefits for November. As a result, no federal SNAP benefits will be distributed starting November 1 unless Congress reaches a funding agreement. Nationally, 41 million Americans currently rely on SNAP benefits for food security.

Impact on the Aging Network

1.9 million Illinoisans will go without new food benefits starting November 1, 2025:

- 45% of SNAP households have children

- 44% include a person with a disability

- 37% include older adults in the home

The Illinois economy will suffer:

- SNAP supports close to 20,000 jobs in local grocery store, farming, manufacturing, and transportation in Illinois

- Every $1 invested in SNAP benefits yields an economic impact of $1.50 to local communities, resulting in a $7.2 billion economic impact annually to the Illinois economy.

ECIAAA Aging Network Impact

East Central Illinois reports 125,958 households receiving SNAP benefits. ECIAAA serves the following sixteen (16) counties, please note total number of SNAP individuals by county (Source: IDOA data collection of individuals of all ages):

- Champaign – 28,041

- Clark – 2,148

- Coles – 8,716

- Cumberland – 3,349

- Douglas – 2,099

- DeWitt – 2,392

- Edgar – 3,320

- Ford – 1,935

- Iroquois – 4,001

- Livingston – 4,653

- Macon – 24,153

- McLean – 18,152

- Moultrie – 1,477

- Piatt – 1,302

- Shelby – 2,340

- Vermilion – 20,032

ECIAAA is prepared to refer older adults losing their SNAP benefits to our local Older Americans Act Nutrition Programs and our County Coordinated Points of Entry/Senior Information Service Providers for assistance. Please contact 1-800-888-4456 or www.eciaaa.org.

How Can You Help?

Illinois food banks and pantries provide 1 meal to every 9 meals that SNAP provides. Supporting your local food bank/pantry is crucial now. Please find food banks and pantries in your local area by clicking link below:

|

|

|

|

|

|

|

|

|

|

|

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: October 2, 2025

RE: The FY 2026 Government Shutdown Is Here

Impact on the Aging Network

Congress failed to reach a funding agreement for FY 2026 (beginning October 1, 2025), and the government has officially shut down and has halted the release of federal funding that is classified as federal discretionary appropriations. The Older Americans Act (OAA) funding that is critical in supporting the Illinois Aging Network falls under the federal discretionary appropriations category. Please find the Administration for Community Living (ACL) Plan here.

ECIAAA Aging Network Impact

Depending on the duration of the shutdown, this gap in funding will have a direct effect on our ability to serve older adults and caregivers in need of critical services and support. We are receiving state funding to support aging services, but at approximately 50% of our operating budget. We are laser-focused on utilizing all available FY 2025 federal resources obligated to ECIAAA to prevent disruptions in services. Members of the U.S. House of Representatives are on recess till next week, so any potential for a resolution on the budget impasse is not expected until then.

Impact on Other Federal Programs

Social Security benefits will continue uninterrupted during the shutdown. Social Security field offices will remain open but SAA services and SSA resources will be reduced during the shutdown. For more details, please click on the Social Security Shutdown Announcement link here.

Medicare coverage will also remain intact during the shutdown.

Medicare coverage will remain intact during the government shutdown, and beneficiaries will continue to receive healthcare services without interruption. Providers may submit claims for payment, though some payments could be delayed due to reduced administrative staffing. According to the CMS contingency staffing plan, non-discretionary activities such as fraud control and core program operations will continue, while certain administrative functions may be curtailed until appropriations are restored.

Medicaid coverage will also remain intact during the shutdown.

CMS has stated that it will maintain sufficient funding to pay states for Medicaid for at least the first quarter of FY 2026 via advance appropriations. However, like Medicare, some related non-essential or discretionary services (e.g. surveys, outreach, and federal oversight) may be reduced or suspended during a funding lapse. (HHS, 2025)

Veterans Medical Services.

During the government shutdown, VA medical services are not shut down. VA medical centers, outpatient clinics, and Vet Centers will continue to provide all services as usual. Administrative support and non-medical services may be affected by the government shutdown.

SNAP Benefits, which offers supplemental nutrition assistance to low-income families nationwide, is expected to provide benefits in October. Each month’s benefits are dispersed the month prior, a spokesperson for the U.S. Department of Agriculture, which also oversees SNAP. The Food Research and Action Center (FRAC) has, however, warned that “November SNAP benefits could be delayed or interrupted entirely” if states do not receive instruction from the USDA on time.

Your Advocacy is Needed Now!

We will accelerate our advocacy role now more than ever. OAA services have improved the lives of over 470,000 older Illinoisians – specifically 24,500 older adults in East Central Illinois. Advocacy is key - we will continue pounding out that message to our lawmakers. Help us in that effort - please contact your congressman or congresswoman now!

Send a Letter to Your Congressman/Congresswoman

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: September 29, 2025

RE: Illinois Multi-Sector Plan for Aging – Final Engagement Sessions

The Illinois Department on Aging, with the help from Health & Medicine Policy, is seeking input from you on how we can help shape the Illinois’ Multi-Sector Plan for Aging. Two virtual webinar engagement sessions are scheduled which we want input to:

- Explore challenges and solutions

- Discus region-specific needs and ideas

- Ensure we hear from underrepresented communities

Make your voice heard! Help to inform the future of aging in Illinois. Everyone plays a role in making Illinois a great place to live, work and support family members, and grow older. Two virtual engagement sessions are scheduled for Thursday, October 2 from 1:00 p.m. to 3:00 p.m. and Thursday, October 9 from 1:00 p.m. to 3:00 p.m. Please click the link below to register. We want to hear from you!

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: September 22, 2025

RE: Did you know that falling is NOT a normal part of aging?

East Central Illinois Area Agency on Aging (ECIAAA) is committed to empowering all older adults in our community to reduce their risk of falls, which are one of the greatest causes of serious injuries and death among people over age 65. On September 22-26, 2025, ECIAAA is partnering with the Illinois Falls Prevention Coalition to mark Falls Prevention Awareness Week.

As part of this national outreach campaign, ECIAAA encourages persons 60 and older to go online to www.ncoa.org/FallsFreeCheckUp at no cost and with anonymity to screen for the most common falls risk factors.

“Falls prevention is crucial because falls are the leading cause of injury-related death and disability, particularly for older adults, leading to serious injuries like hip fractures and head trauma, costly hospitalizations, long-term rehabilitation, and reduced independence and quality of life,” said Susan Real, CEO, ECIAAA.

East Central Illinois Area Agency on Aging has a strong history of helping older residents in our community. ECIAAA is proud to be part of this state education and outreach initiative that is helping millions of older adults age well and stay falls free.

If you live in Champaign, Clark, Coles, Cumberland, DeWitt, Douglas, Edgar, Ford, Iroquois, Livingston, Macon, McLean, Moultrie, Piatt, Shelby or Vermilion counties and want to learn more about resources to prevent falls, contact ECIAAA at (800) 888-4456.

Debunking the Myths of Older Adult Falls

Fall Prevention Guide for Caregivers

This project is supported by the Administration for Community Living (ACL), U.S. Department of Health and Human Services (HHS) as part of a financial assistance award totaling $150,000 with 100 percent funding by ACL/HHS. The contents are those of the author(s) and do not necessarily represent the official views of, nor an endorsement, by ACL/HHS, or the U.S. Government.

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: September 3, 2025

RE: Federal - FY 2026 Older Americans Act (OAA) Appropriations

The Senate Appropriations Committee approved its version of the FY 2026 HHS Spending Bill which sustained all OAA Programs with level funding allocations (OAA Title IIIB, IIIC, IIIE, IIID and VII - funding levels extended from FY 2024) except for a $2M increase in Title IIIE Family Caregiver Support Program funding. The Senate also restored proposed funding for the following programs (which were eliminated in the President’s proposed budget for FY 2026):

- OAA Title V Senior Community Employment Program (SCSEP)

- Low Income Home Energy Assistance Program (LIHEAP)

- Community Services Block Grant Program (CSBG)

- Corporate for National and Community Services.

The House of Representatives has yet to release their HHS proposal for FY 2026 OAA funding. The time is now to let your Congresswoman/Congressman know that the OAA is the main source of funding for services such as meals, informal/family caregiver support, legal support, benefit access assistance and the long-term care ombudsman program. Over 24,000 eligible clients are being served by these critical services in East Central Illinois. Please request your Congresswoman/Congressman to prioritize funding for the OAA and other critical programs that help older adults live independently, safely and with dignity.

SEND A LETTER TO YOUR CONGRESSMAN/CONGRESSWOMAN

FY 2023-FY 2026 Federal Appropriations Chart

State Level – Illinois Multi-Sector Plan for Aging Engagement Sessions

The Illinois Department on Aging, with the help from Health & Medicine Policy, is seeking input from you on how we can help shape the Illinois’ Multi-Sector Plan for Aging.

Make your voice heard! Help to inform the future of aging in Illinois. Everyone plays a role in making Illinois a great place to live, work and support family members, and grow older. Two virtual engagement sessions are scheduled for Monday, September 8 from 10:00 a.m. to 12 p.m.; and October 2 from 1:00 p.m. to 3:00 p.m. Please click the link below to register. We want to hear from you!

Please contact me at This email address is being protected from spambots. You need JavaScript enabled to view it. with questions. Thank you.

Be Safe & Be Well!

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: July 14, 2025

RE: 60th Anniversary of the Older Americans Act on July 14th!

Today, July 14, we celebrate the 60th Anniversary of the Older Americans Act. National aging service organizations (Advancing States, NANASP, NCOA, MOWA and USAging) have joined forces to honor this historic Act. In a press release dated July 7, 2025, they stated … “For six decades, the Older Americans Act (OAA) has connected older adults to vital services that help people age with health and dignity—in their own homes and communities, where they want to be. In 1965, the OAA was transformational for older adults, and today, it still stands as the only national framework comprehensively addressing the social services needs of older adults in the community. The Act continues to be one of the most successful examples of public-private partnerships in action and leverages $3 for every $1 invested by the federal government. As the U.S. population ages –projected to include more than 97 million Americans over age 60 by 2040 – we must safeguard these vital OAA programs that are trusted, proven and have withstood the test of time.”

OAA programs and services aren’t optional services: they are the foundation of independence, health, and well-being for millions. Thanks to the OAA, over 478,000 older Illinois adults were served by the Illinois Aging Network (over 24,000 older adults in East Central Illinois). Critical services received include home delivered meals, congregate meals, information and assistance, options counseling, in-home programs, healthy aging/wellness programs, legal assistance, transportation and social connections programs. Family caregivers of older adults are also served by the OAA with respite care, training, support and access to other resources. OAA programs and services are delivered through a nationwide network of state and local agencies and service providers that are deeply rooted in their communities, equipping them to meet the unique needs of local older adults and caregivers, particularly those most in need of assistance to age well and remain in their homes and communities.

OAA services are person-centered and more cost-effective than other forms of health or long-term care, including hospitals and nursing homes. When older adults can safely and successfully age at home, families and taxpayers alike benefit.

While we celebrate the OAA’s 60th anniversary, we know that continued progress requires continued support. Most critically, federal funding for OAA programs must increase to reach all older adults in need.

| OAA Factsheet |

|

|

|

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: June 3, 2025

RE: Director's Report: ADOVACY IN ACTION- Older American Act Funding Saved for FY 2026

Thank you to everyone who joined us during ECIAAA’s Day of Action - Don’t Blow Out the Candles on the Older Americans Act! It was a success, and our advocacy efforts worked.

Late Friday, the President’s proposed detailed FY 2026 budget was released. Through USAging, our AAA National Association, we now have more information detailing specific funding titles. The official FY 2026 President’s Budget proposes better news for the Older Americans Act (OAA) programs than originally expected.

Highlights of the official FY 2026 President’s Budget.

- Administration for Children and Families will house all OAA programs.

- Almost all OAA programs are proposed at level funding (FY 2025 funding levels).

- The budget provides $1.9 billion to support the Nation’s Comprehensive Area Agency on Aging Service Network. The proposed allocation by program is listed below:

- Title III B Home and Community-Based Supportive Services ($410 million)

- Title III C1 and C2 ($1.1 billion)

- Title III D Evidence-Based Prevention Health Services ($26 million)

- Title III E Family Caregiver Support ($207 million),

- Title VI Part A Nutrition ($38 million), Part C Caregivers ($12 million)

- Title VII: Prevention of Elder Abuse and Long-Term Care Ombudsman ($27 million)

- Adult Protective Services ($30 million)

- Senior Medicare Patrol Program ($35 million)

- Aging and Disability Resource Centers ($9 million)

- State Health Insurance Assistance Program ($55 million)

- Adults Protective Services and Elder Rights Support ($34 million)

- The budget also reflects the $50 million in mandatory funding for SHIPs, AAAs, ADRCs and the National Center for Benefits Outreach and Enrollment through FY 2026.

The Bad News.

The President’s budget eliminates the Low-Income Home Energy Assistance Program (LIHEAP), the Community Services Block Grant (CSBG), and Title V Senior Community Service Employment Program (SCSEP).

Under the current Reconciliation Bill, the U.S. House of Representatives has passed deep cuts to Medicaid and SNAP which are now being considered by the U.S. Senate. These cuts will adversely affect many older adults we serve. Please note, the reconciliation process is separate from the appropriations process.

Our Advocacy Isn’t Finished!

The President’s FY 2026 Budget is only a blueprint, not an actual appropriations bill. Congress must agree to implement these levels through their appropriations process which beings this week. Check out USAging’s appropriations chart for more details. We will keep you posted on our continued Advocacy efforts in East Central Illinois.

Check out the ECIAAA Advocacy Day Events – Don’t Blow Out the Candles on the Older Americans Act on May 28, 2025:

News Coverage in Illinois: WGLT

News Coverage in Illinois: WCIA

News Coverage in Illinois: JG-TC

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: May 18, 2025

RE: May 28th Advocacy Day --Don’t Blow Out the Candles on the Older Americans Act!

As we celebrate Older Americans Month, funding for the Older Americans Act is facing serious threats. These programs and services aren't optional services; they are the foundation of independence, health, and well-being for millions." - Sandy Markwood, CEO of USAging

Don’t Blow Out the Candles on the Older Americans Act DAY OF ACTION!

Across Illinois, threats to the Older Americans Act have wreaked havoc for aging service providers and Area Agencies on Aging. Earlier this year, revealed budget information from the Trump Administration shows potential cuts to Older Americans Act funding that would greatly impact older adults and their caregivers across Illinois. These proposed cuts threaten programs that include falls prevention, evidence-based health promotion programs, respite care for burdened caregivers, the Long-Term Care Ombudsman program, and elder justice initiatives - including Adult Protective Services.

The Illinois Association of Area Agencies on Aging is calling for a day of action on May 28th to commemorate the 60th anniversary of the passage of the Older Americans Act - with a call to Congress saying “DON’T BLOW OUT THE CANDLES ON THE OLDER AMERICANS ACT.” We are calling all legislators, lawmakers, older adults, and caregivers to join us at events across the state to highlight the importance of these critical services that impact hundreds of thousands of older adults across Illinois.

Over 24,000 older adults in East Central Illinois will lose – they will lose meals, lose in-home support services, and lose critical benefits if the Older Americans Act is cut. This means that older adults will have an increased risk of losing the ability to live independently. Please join us on May 28th!

Events scheduled for East Central Illinois Area Agency on Aging:

Statewide Day of Action: Bloomington-Normal

Statewide Day of Action: Charleston-Mattoon

Be Safe & Be Well!

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: May 7, 2025

RE: Older Americans Month 2025– Flip the Script on Aging

Established in 1963, Older Americans Month (OAM) is celebrated every May. Older Americans Month is a time for us to acknowledge the contributions and achievements of older Americans, highlight important trends, and strengthen our commitment to honoring our older adults.

This year’s theme, "Flip the Script on Aging," focuses on the importance of combating ageism to transform how society perceives, talks about, and approaches aging by challenging stereotypes and highlighting the benefits of healthy aging.

How can community groups, businesses, and organizations mark Older Americans Month?

• Promote Older Americans Month within professional and personal networks.

• Encourage followers to share thoughts and stories on social using #FlipTheScriptOnAging.

• Share tips on language and activities that dispel myths about aging.

• Host events or programs where older adults can mentor peers, younger adults, or youths to help dispel misconceptions about ageism.

What can individuals do to combat ageism?

• Celebrate the contributions of people of all ages in the workplace and community.

• Avoid ageist statements when talking about growing older.

• Promote fact-based messages about older adults’ abilities and value to communities.

On April 14, 2025, the Board of Directors of the East Central Illinois Area Agency on Aging voted to proclaim May as Older Americans Month for the counties of Champaign, Clark, Coles, Cumberland, DeWitt, Douglas, Edgar, Ford, Iroquois, McLean, Macon, Moultrie, Piatt, Shelby and Vermilion in East Central Illinois. View the Proclamation.

For more information, visit the official OAM website, follow ECIAAA on Facebook, and join the conversation using #OlderAmericansMonth.

"As we celebrate Older Americans Month, funding for the Older Americans Act is facing serious threats. These programs and services aren't optional services; they are the foundation of independence, health, and well-being for millions." - Sandy Markwood, CEO of USAging

Advocacy Materials

Learn more and help us advocate for critical OAA programs by accessing the documents below!

Loss of OAA Services Impact Statement

IL Family Caregiver Act (SB 2617, HB 4014)

IL Family Caregiver Impact Statement

Be Safe & Be Well – Happy Older Americans Month!

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: Feburary 25, 2025

RE: Call to Action! Uncertain Times for the Older Americans Act (OAA)

We are navigating uncertain times. There are many unknowns right now, with limited communication from the federal agencies that affect our work and our client’s lives. Presently, Older Americans Act (OAA) federal funding continues to flow to the Aging Network, but we face challenges in preserving the Older Americans Act and OAA funding due to the existing turmoil in Washington D.C. As advocates for older adults, the Illinois Association of Area Agencies and USAging have kicked into high gear in alerting members of Congress of the critical services provided through the Older Americans Act – the framework by which the Illinois Aging Network served over 478,000 older adults in Illinois, and over 24,000 in East Central Illinois. We have implemented a Call to Action! Campaign in East Central Illinois.

A Call to Action! ECIAAA is requesting client-impact stories and videos from funded service providers to send a clear message to our elected officials. We have already received a number of stories that we are preparing for submission to our Congressional Members. Join in this effort by clicking on the link below.

SEND A LETTER TO YOUR CONGRESSMAN/CONGRESSWOMAN

A Call to Action! ECIAAA continues one on one meetings with members of Congress serving East Central Illinois to garner support for the reauthorization of the Older Americans Act and continued funding. ECIAAA regularly informs lawmakers of the incredible services provided to over 478,000 older adults in Illinois, 16.5% of the Illinois 60+ population. So, we have created fact sheets that describe, for example, how many nutrition meals would be lost monthly, or the number of caregivers would not be served monthly, if OAA funding is cut. OAA services save the older adult AND the government money by way of reduced medical costs and nursing home costs. See below.

THE CAREGIVING SAVINGS FACT SHEET

A Call to Action! Welcoming Congressional members to visit nutrition sites, senior centers, and special events focusing on services to older adults. ECIAAA is in the process of arranging such visits.

“Our mission is to lead and advocate for inclusive resources and services that empower the optimal aging of East Central Illinois' diverse older adults, individuals with disabilities, and their care partners.”

A Call to Action! In keeping with our mission, ECIAAA is so grateful for your collaboration and support as community partners. And I am so grateful for our OAA-funded service providers and their dedication in providing direct services to over 24,000 older adults, caregivers, grandparents/relatives raising grandchildren/children, and individuals with disabilities throughout the 16-counties of East Central Illinois. ECIAAA needs your help now in supporting our advocacy efforts in preserving the Illinois Aging Network!

Please contact me at This email address is being protected from spambots. You need JavaScript enabled to view it. with questions. Thank you.

Be Safe & Be Well!

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: January 2, 2025

RE: FY 2025 Older Americans Act Update

As we welcome the New Year, I wanted to share important news about the Older Americans Act..

Continuing Resolution

According to USAging, Congress passed, and the President signed its second short-term funding bill that prevents a government shutdown before the holidays. This short-term funding bill, known as a continuing resolution (CR), will continue to fund the government at FY 2024 funding levels through March 14, 2025. This will allow Congress more time to negotiate a final FY 2025 spending bill until the new Congress is seated. Though the CR funds the Older Americans Act at FY 2024 funding levels, the bill also provided authorization and funding for the Medicare Improvements for Patients and Providers Act (MIPPA) funding for SHIPs, AAAs and ADRCs though March 2025.

Older Americans Act Reauthorization

The bill did not include the reauthorization of the Older Americans Act (OAA) to our deep disappointment. We were encouraged that the original bipartisan funding bill crafted included the bipartisan five-year reauthorization of the OAA would pass. However, the OAA reauthorization was dropped at the 11th hour. Our Aging Network did an outstanding job advocating for the passage of the OAA Reauthorization. The final reauthorization bill as proposed had bipartisan and bicameral support and deserved to be passed before the end of this Congress.

Next Steps

As Congress proceeds with negotiations, we will continue to advocate for a final FY 2025 funding bill. However, our immediate advocacy efforts will be focused on preserving current funding for Older Americans Act (OAA) programs throughout the remainder of the fiscal year.

Thank you to those of you who reached out to members of Congress during the recent negotiation period. You continue to make a difference. ECIAAA stands ready to support the Aging Network. Please do not hesitate in contacting us at 1-800-888-4456 with your questions. Thank you for your dedication as we continue to support older adults, family caregivers, and grandparents raising grandchildren in East Central Illinois.

Be Safe & Be Well & Happy New Year!

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: May 15, 2024

RE: Older Americans Month 2024– Powered By Connection

Established in 1963, Older Americans Month (OAM) is celebrated every May. Led by the Administration for Community Living (ACL), OAM is a time for us to acknowledge the contributions and achievements of older Americans, highlight important trends, and strengthen our commitment to honoring our older adults.

This year’s theme, "Powered by Connection," focuses on the profound impact that meaningful connections have on the well-being and health of older adults — a relationship underscored by the U.S. Surgeon General's Advisory on the Healing Effects of Social Connection and Community.

It's not just about having someone to chat with, it's about the transformative potential of community engagement in enhancing mental, physical, and emotional well-being. By recognizing and nurturing the role that connectedness plays, we can mitigate issues like loneliness, ultimately promoting healthy aging for more Americans.

How can community groups, businesses, and organizations mark Older Americans Month?

- Spread the word about the mental, physical, and emotional health benefits of social connection through professional and personal networks.

- Encourage social media followers to share their thoughts and stories of connection using hashtag #PoweredByConnection to inspire and uplift.

- Promote opportunities to engage, like cultural activities, recreational programs, and interactive virtual events.

- Connect older adults with local services, such as counseling, that can help them overcome obstacles to meaningful relationships and access to support systems.

- Host connection-centric events or programs where older adults can serve as mentors to peers, younger adults, or youths.

What can individuals do to connect?

- Invite more connection into your life by finding a new passion, joining a social club, taking a class, or trying new activities in your community.

- Stay engaged in your community by giving back through volunteering, working, teaching, or mentoring.

- Invest time with people to build new relationships and discover deeper connections with your family, friends, colleagues, or neighbors.

On May 15, 2024, the Board of Directors of the East Central Illinois Area Agency on Aging voted to proclaim May as Older Americans Month for the counties of Champaign, Clark, Coles, Cumberland, DeWitt, Douglas, Edgar, Ford, Iroquois, McLean, Macon, Moultrie, Piatt, Shelby and Vermilion in East Central Illinois. View the Proclamation.

For more information, visit the official OAM website, follow ECIAAA on Facebook, and join the conversation using #OlderAmericansMonth.

![]()

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Chief Executive Officer

DATE: March 11, 2024

RE: FY 2025 Governor Pritzker’s Proposed Budget – Illinois Aging Budget

On February 21, 2024, Governor J.B. Pritzker submitted the proposed FY 2025 Illinois operating budget to the members of the General Assembly and people of the State of Illinois. The $52.7 billion operating budget for the fiscal year beginning July 1st represents a 6% increase compared to the FY 2024 budget. The introduced budget includes proposed reductions in operating budgets of State Agencies from reduced travel and improved efficiencies.

FY 2024 Introduced Budget Illinois Department on Aging (IDoA) – Total General Funds increase of 11.5%:

| Fund Name | FY 2024 Enacted Appropriations | FY 2025 Governor’s Introduced |

Change from FY 2024 $ |

Percentage Change from FY 2024 % |

| General Revenue Fund | $461,079,788 | $619,997,300 | $158,917,522 | 34.5% |

| Commitment to Human Services Fund | $964,693,700 | $971,162,100 | $6,468,400 | 0.7% |

| Other State Funds | $7,745,000 | $7,745,000 | $0 | 0% |

| Federal Funds | $185,518,200 | $164,395,400 | -$21,122,800 | -11.4% |

| Total All Funds | $1,619,036,678 | $1,763,299,800 | $144,263,122 | +8.9% |

The decrease in Federal funds reflects the readjusting to pre-pandemic levels of appropriations spending authority.

FY 2025 Introduced Budget – Illinois Department on Aging Budget Highlights:

Budget Highlights

- Both a $54.6 million supplemental for the Community Care Program (CCP); and, a $3.5 million supplemental for Care Coordination Units (CCUs) are recommended in fiscal year 2024. The recommended fiscal year 2025 budget maintains funding at the new level for CCU.

- The recommended fiscal year 2025 budget includes $104.4 million increase in funding for CCP to accommodate caseload growth and utilization and to cover the costs of annualizing the January 1, 2024 $1.15 per hour rate increase for in-home providers. The CCP helps senior citizens, who might otherwise need nursing home care, remain in their own homes by providing in-home and community-based services.

- The recommended fiscal year 2025 budget includes $3.0 million to meet increased demand for Home Delivered Meals. The Aging Network provides more than 11 million meals to homebound older adults across the state.

- The recommended fiscal year 2025 budget includes maintenance State funding to support Illinois Family Caregiver Act services. AARP has estimated that in Illinois, over 1.3 million unpaid, informal (family/friends) caregivers provide support their loved ones – preventing premature institutionalization.

- The recommended fiscal year 2025 budget includes maintenance State funding to support services in rural areas and increased outreach to minority communities.

- The recommended fiscal year 2025 budget includes a $21.1 million reduction in federal funds appropriations due to exhausted COVID relief funding.

FY 2025 Budget Action by the Illinois General Assembly – May 24, 2024.

Illinois lawmakers will take on the review and approval of a final FY 2025 budget during the spring session of the 103rd Illinois General Assembly. We will keep you posted as negotiations develop.

ECIAAA stands ready to support the Aging Network. Please do not hesitate in contacting us at 1-800-888-4456 with your questions. Thank you all for your dedication as we continue to support older adults, family caregivers, and grandparents raising grandchildren in east central Illinois.

FY 2025 Proposed Budget in Brief FY 2025 Proposed Operating Budget

![]()

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Executive Director/Chief Executive Director

DATE: November 16, 2023

RE: November is National Family Caregivers Month

November is National Family Caregivers Month! Please join me in recognizing and honoring family caregivers in East Central Illinois. Celebrating family caregivers during National Family Caregiver Month gives us a chance to celebrate the efforts taken to support the estimated 1.3 million caregivers in Illinois. Their collective effort results in 1.23 billion hours of unpaid care annually at an economic value of $21 billion. Please take a minute to review the following:

- Raise Awareness of Family Caregiver Issues: Illinois Family Caregiver Resolution. On November 10, 2023, the Illinois Family Caregiver Resolution was filed as HR506 by the Illinois General Assembly. This is the first time Illinois has adopted a Resolution recognizing the estimated 1.3 million Illinois family caregivers providing care to care-recipients to help make it possible for older adults, people with disabilities and veterans to live independently in their homes and communities, and they are the backbone of the care system in Illinois and across the United States. We wish to thank AARP, Illinois Association of Area Agencies on Aging (I4A), and the Illinois Family Caregiver Coalition for launching this effort. View the Illinois Resolution.

- Presidential Proclamation 2023: On October 31, President Biden Proclaimed November 2023 as National Family Caregiver Month. In a press release, President Biden recognized the love and sacrifice of millions of American caregivers by stating… “Let us celebrate and honor our caregivers and renew our efforts to protect their dignity, health and security. Because when we care for caregivers, we honor our American ideals and mover closer to a future where not one in this Nation is left behind.” View the President’s Proclamation.

- Celebrate the Efforts of Family Caregivers: On September 20, 2023, ECIAAA proudly recognized our nine (9) Caregiver Advisory Programs, sixteen (16) Caregiver Advisors (staff), and ten (10) Caregiver Champions (5 family caregivers and 5 grandparents/relatives raising grandchildren/children) during the Annual Luncheon. During FY 2022, the ECIAAA Caregiver Advisory Programs served over 1,100 caregivers and grandparents/relatives raising grandchildren/children. View ECIAAA’s presentation honoring the Caregiver Advisory Programs and Caregiver Champions.

- Educate Family Caregivers About Self-Identification: As a member of the Illinois Family Caregiver Coalition (IFCC) and under the leadership of Amy Brennan, IFCC Director, we are working with many partner agencies to better target the estimated 1.3 million family caregivers in Illinois. We are working on ways to refine our messaging – so help family caregivers recognize that they are caregivers and are eligible to receive supportive services. To support our cause, please join the Illinois Family Caregiver Coalition.

- Increase Support for Family Caregivers: ECIAAA, in conjunction with I4A and the Illinois Family Caregiver Coalition, interviewed twenty-five family caregivers across Illinois. The stories were extremely powerful as they described each caregiver’s journey. In addition, we used the stories to help with I4A’s advocacy efforts to increase funding support through the Illinois General Assembly and U.S. Congress. View the synopsis of Illinois Family Caregiver Stories collected during 2023.

- Reduce Feelings of Isolation: ECIAAA has launched several pilot projects to help reduce social isolation among older adults, including family caregivers. Plus, we currently fund the Stress Busting for Family Caregivers program. In addition, ECIAAA has adopted as a local initiative, the development and designation of Dementia Friendly America Communities in East Central Illinois. Finally, we value our partnership with the Alzheimer’s Association in bringing programs and support to family caregivers of older adults with Alzheimer’s Disease and related dementias.

- Graphics for Social Media Posts: Please utilize the variety of social media graphics down below to promote National Family Caregivers Month with us!

Advocacy Image #1 Advocacy Image #2 Advocacy Image #3

![]()

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Executive Director

DATE: June 27, 2023

RE: FY 2024 Budget Highlights- State & Federal

As State Fiscal Year 2023 comes to a close, I wanted to take this opportunity to highlight state and federal budget items affecting older adults in Illinois. The Illinois Department on Aging’s budget was approved by the Illinois General Assembly as first introduced by Governor Pritzker, marking increased funding in several programs.

Illinois Department on Aging Budget Highlights

- $1.3 million to assist with gaps in senior service access throughout the state.

- An additional $1.3 million to support last year’s investment of $4 million for a total of $5.3 million to enhance support services available to unpaid family caregivers.

- $1.2 million to expand outreach efforts in targeted communities, to better reach and serve Illinois’ growing population of historically marginalized older adults.

- An increase of $8 million for a total of $52.3 million in state funds for home-delivered meals to maintain current Home Delivered Meal levels after ARPA funds are depleted.

- $1 million to sustain Reducing Social Isolation among Older Adults Initiatives launched by Area Agencies on Aging (AAAs) during FY 2020 and continued through FY 2023.

- $1 million to sustain Alzheimer’s Disease and Related Dementias programming launched by AAAs during FY 2022 and continued in FY 2023.

Personal Needs Allowance (PNA) for Medicaid Residents in Nursing Homes Approved Increase from $30 to $60

Section 60-5. The Illinois Public Aid Code has been amended by adding Section 5-35 as follows:

(305 ILCS 5/5-35.5 new) Sec. 5-35.5. Personal needs allowance; nursing home residents. Subject to federal approval, on or after January 1, 2024, for a person who is a resident in a facility licensed under the Nursing Home Care Act for whom payments are made under this Article throughout a month and who is determined to be eligible for medical assistance under this Article, the monthly personal needs allowance shall be $60.

Thank you to ECIAAA’s Long Term Care Ombudsmen for their fantastic work advocating for this PNA increase to $60!

Fiscal Responsibility Act of 2023: How It Will Affect Older Illinoisans?

The debt ceiling bill caps overall spending levels for non-defense discretionary (NDD) programs for FY 2024 and FY 2025. This amounts to freezing overall spending levels at the FY 2022 level. NOTE: Older Americans Act (OAA) funding falls under NDD programs. Since the older adult population is increasing every year, with the funding held at FY 2022 levels, older adults will face reduced services during upcoming fiscal years. This spending cap will make it tougher to advocate for increases in OAA funding, specifically OAA Title III-B funds which have seen little to no increases over many years. One positive note, Older Americans Act COVID-19 funding was not affected since this funding was already obligated to the states.

Enclosures: Approved IDOA Budget

ECIAAA Personal Needs Allowance Infographic

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Executive Director

DATE: May 17, 2023

RE: Older Americans Month 2023– Aging Unbound

Established in 1963, Older Americans Month (OAM) is celebrated every May. Led by the Administration for Community Living (ACL), OAM is a time for us to acknowledge the contributions and achievements of older Americans, highlight important trends, and strengthen our commitment to honoring our older adults.

This year’s theme, Aging Unbound, offers an opportunity to explore a wide range of aging experiences and to promote the importance of enjoying independence and fulfillment by paving our own paths as we age.

This May, join us as we recognize the 60th anniversary of OAM and challenge the narrative on aging. Here are some ways we can all participate in Aging Unbound:

- Embrace the opportunity to change: Find a new passion, go on an adventure, and push boundaries by not letting age define your limits. Invite creativity and purpose into your life by trying new activities in your community to bring in more growth, joy, and energy.

- Explore the rewards of growing older: With age comes knowledge, which provides insight and confidence to understand and experience the world more deeply. Continue to grow that knowledge through reading, listening, classes, and creative activities.

- Stay engaged in your community: Everyone benefits when everyone is connected and involved. Stay active by volunteering, working, mentoring, participating in social clubs, and taking part in activities at your local senior center or elsewhere in the community.

- Form relationships: As an essential ingredient of well-being, relationships can enhance your quality of life by introducing new ideas and unique perspectives. Invest time with people to discover deeper connections with family, friends, and community members.

On May 17, 2023, the Board of Directors of the East Central Illinois Area Agency on Aging voted to proclaim May as Older Americans Month for the counties of Champaign, Clark, Coles, Cumberland, DeWitt, Douglas, Edgar, Ford, Iroquois, McLean, Macon, Moultrie, Piatt, Shelby and Vermilion in East Central Illinois. View the Proclamation here.

For more information, visit the official OAM website, follow ECIAAA on Facebook, and join the conversation using #OlderAmericansMonth.

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Executive Director

DATE: February 23, 2023

RE: FY 2024 Governor Pritzker’s Proposed Budget – Illinois Aging Budget

On February 15, 2023, Governor J.B. Pritzker submitted the proposed FY 2024 Illinois operating budget to the members of the General Assembly and people of the State of Illinois. The $49.6 billion operating budget for the fiscal year beginning July 1st represents a 0.7% decrease compared to the FY 2023 budget. The introduced budget includes proposed reductions in operating budgets of State Agencies from reduced travel and improved efficiencies.

FY 2024 Introduced Budget Illinois Department on Aging (IDoA) – Total General Funds increase of 12.7%:

|

Fund Name |

FY 2023 Enacted Appropriations ($ thousands) |

FY 2024 Governor’s Introduced ($ thousands) |

Change from FY 2023 ($ thousands) |

Percentage Change from FY 2023 % |

|

General Revenue Funds |

$385,565.7 |

$434,504.8 |

$48,939.1 |

12.7% |

|

Commitment to Human Services Fund |

$957,758.7 |

$964,693.7 |

$6935.0 |

0.7% |

|

Federal Funds |

$309,491.3 |

$185,518.2 |

-$117,973.1 |

-38.9% |

|

Other State funds |

$6,745.0 |

$7,745.0 |

$1,000.0 |

14.8% |

|

Total All funds |

$1,653,560.7 |

$1,592,461.7 |

-$61,099.0 |

-3.7% |

The decrease in Federal funds reflects the readjusting to pre-pandemic levels of appropriations spending authority.

FY 2024 Introduced Budget – Illinois Department on Aging Budget Highlights:

- In response to ongoing challenges within the in-home care worker universe, the Department submitted a proposed amendment to the Centers for Medicare & Medicaid to increase the rate for in-home care workers effective upon approval from $25.66 to $26.92, which is a $49.5 million investment of state funds in FY 24.

- The FY 24 Governor’s Proposed Budget includes funding that will allow for additional waiver services, creating new care opportunities for Illinois seniors. This opportunity for expansion of CCP is due to Federal FMAP incentive payments under the American Rescue Plan.

- $1.3 million to assist with gaps in senior service access throughout the state.

- An additional $1.3 million to support last year’s investment of $4 million for a total of $5.3 million to enhance support services available to unpaid family caregivers.

- $1.2 million to expand outreach efforts in targeted communities, to better reach and serve Illinois’ growing population of historically marginalized older adults.

- An increase of $8 million for a total of $52.3 million in state funds for home-delivered meals to maintain current Home Delivered Meal levels after ARPA funds are depleted.

- $1 million to sustain Reducing Social Isolation among Older Adults Initiatives launched by Area Agencies on Aging (AAAs) during FY 2020 and continued through FY 2023.

- $1 million to sustain Alzheimer’s Disease and Related Dementias programming launched by AAAs during FY 2022 and continued in FY 2023.

FY 2024 Budget Action by the Illinois General Assembly – May 19, 2023.

Illinois lawmakers will take on the review and approval of a final FY 2024 budget during the spring session of the 103rd Illinois General Assembly. We will keep you posted as negotiations develop.

ECIAAA stands ready to support the Aging Network. Please do not hesitate in contacting us at 1-800-888-4456 with your questions. Thank you all for your dedication as we continue to support older adults, family caregivers, and grandparents raising grandchildren in east central Illinois.

View Proposed FY 2024 Budget in Brief

View Proposed FY 2024 Operating Budget

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Executive Director

DATE: January 3, 2023

RE: FY 2023 Appropriations Bill- Final Federal Budget

On Thursday, December 29, 2022, President Biden signed a $1.7 trillion omnibus appropriations bill funding government operations through September 2023. Overall, the bill includes $2.5 billion for the Administration for Community Living, an increase of $220 million above FY 2022. (Sources: USAging and Meals on Wheels America)

Older Americans Act (OAA):

- $410 million, an increase of $11 million (2.7 percent) above the FY 2022 enacted level for OAA Title III BHome & Community-Based Supportive Services.

- $1.1 billion, an increase of $100 million (10 percent) above the FY 2022 enacted level for OAATitle III C Nutrition Services.

- $205 million, an increase of $11 million (5.6 percent) above the FY 2022 enacted level for OAATitle III E National Family Caregiver Support Program.

- $50.2 million, an increase of $2.7 million (5.6 percent) above the FY 2022 enacted level for OAA Title VI Native American Nutrition, Supportive and Caregiver Services.

- $26.2 million, an increase of $1.5 million (6 percent) above the FY 2022 enacted level for OAA Title III D Evidence-Based Health Promotion and Disease Prevention.

- $26.6 million, an increase of $2 million (8 percent) over FY 2022 levels for OAA Title VII Long-Term Care Ombudsman Program.

Other Key Programs:

- $10 million, an increase of nearly $1 million (12 percent) above the FY 2022 enacted level for Lifespan Respite Carereceived for a total of to address existing gaps in respite care for older adults and people with disabilities.

- $237 million, an increase of $6.1 million (2.6 percent) above the FY 2022 enacted level in funding for the three programs under the AmeriCorps Seniors umbrella—RSVP, the Foster Grandparent Program, and the Senior Companion Program.

- $405 million for the Senior Community Service Employment Program (Title V of the Older Americans Act), which is level funding.

- $5.5 million, an increase of $1.5 million (37.5 percent) above the FY 2022 enacted level for the Community Care Corps grant program within funding for Aging Network Support Activities.

- $804.3 million, a $49.3 million increase (6.5 percent) above the FY 2022 enacted level for the Community Services Block Grant. The Social Services Block Grant received level funding at $1.7 billion. $4 billion, a $200 million increase (0.1 percent) for discretionary funding of the Low-Income Home Energy Assistance Program(LIHEAP).

- Funding for Aging and Disability Resource Centers remains at $8.1 million.

- $55 million, an increase of $2 million (3.7 percent) above the FY 2022 enacted level for State Health Insurance Assistance Programs.

- The bill also encourages ACL to coordinate with the Department of Labor to identify and reduce barriers to entry for a diverse and high-quality direct care workforce, and to explore new strategies for the recruitment, retention and advancement opportunities needed to attract or retain direct care workers.

Final Note:

Overall, the majority of the Older Americans Act (OAA) programs and services received increases for 2023, although most increases were modest when compared to the President’s original budget request, as well as the House Appropriations Committee’s request. The original requests better reflected the need for enhanced resources for the Aging Network given growing demand and workforce challenges.

The funding bill represents a bipartisan effort to finalize the budget for FY 2023, eliminating the uncertainty of funding for the Aging Network. ECIAAA wishes to thank the Illinois Congressional Delegation for supporting Older Americans Act services for FY 2023.

ECIAAA stands ready to support the Aging Network. Please do not hesitate in contacting us at 1-800-888-4456 with your questions. Thank you all for your dedication as we continue to support older adults, family caregivers, and grandparents raising grandchildren in East Central Illinois.

To review these proposed allocations in a chart format, please click here to view USAging’ s appropriations chart.

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Executive Director

DATE: December 5, 2022

RE: Final Grant Awards for FY 2023

The East Central Illinois Area Agency on Aging (ECIAAA) announces the Older Americans Act (OAA) and Illinois General Revenue Fund (GRF) awards for FY 2023. Funding supports programs that help over 23,000 vulnerable older adults live with independence and dignity in their homes and communities in East Central Illinois. Funding also supports family non-paid caregivers of older adults, grandparents raising grandchildren, and individuals with disabilities. A total of $7,769,326 in OAA/GRF funding was awarded to the following community based organizations in the counties of Champaign, Clark, Coles, Cumberland, DeWitt, Douglas, Edgar, Ford, Iroquois, Livingston, McLean, Macon, Moultrie, Piatt, Shelby and Vermilion.

SARAH BUSH LINCOLN PEACE MEAL NUTRITION PROGRAM

- $1,161,698 for the following services by county:

- Congregate and Home Delivered Meals – Clark, Coles, Cumberland, Douglas, Edgar, Moultrie and Shelby

CRIS HEALTHY-AGING CENTER

- $1,231,601 for the following services by county:

- Senior Information Services/Options Counseling – Champaign & Vermilion

- Reducing Social Isolation- Champaign and Vermilion

- Congregate & Home Delivered Meals – Vermilion

- Evidence Based/Healthy Aging Programs – Champaign & Vermillion

- Caregiver Advisor for Family Caregivers & Grandparents Raising Grandchildren - Champaign & Vermilion

- Respite for Family Caregivers – Vermilion

- Adult Protective Services Multidisciplinary & Training Support – Vermilion

STARTING POINT/MACON COUNTY HEALTH DEPARTMENT

- $272,259 for the following services by county:

- Senior Information Services/Options Counseling – Macon

- Reducing Social Isolation- Macon

- Evidence Based/Healthy Aging Programs – Macon

- Caregiver Advisor for Family Caregivers & Grandparents Raising Grandchildren – Macon

- Respite for Family Caregivers – Macon

LIVINGSTON COUNTY HEALTH DEPARTMENT

- $964 for the following services by county:

- Respite Services for Caregivers – Livingston

CARE HORIZON

- $9,542 for the following services:

- Adult Protective Services Multidisciplinary Team/Training – Champaign Clark, Coles, Cumberland, Douglas, Edgar, Moultrie, Piatt, and Shelby

- Respite for Family Caregivers – Champaign, Coles, DeWitt, Douglas, Edgar & Piatt

COMMUNITY CARE SYSTEMS, INC

- $602,532 for the following services by county:

- Senior Information Services/Options Counseling – DeWitt, Livingston, McLean & Shelby

- Reducing Social Isolation- McLean

- Gerontological Counseling – McLean

- Evidence Based/Healthy Aging Programs – McLean, Livingston & DeWitt

- Caregiver Advisor for Family Caregivers & Grandparents Raising Grandchildren –McLean, DeWitt and Livingston

- Respite for Family Caregivers – Clark, Cumberland, McLean, Moultrie & Shelby

CATHOLIC CHARITIES MEALS ON WHEELS

- $911,695 for the following services by county:

- Reducing Social Isolation- Macon

- Congregate and Home Delivered Meals – Macon

- Evidence Based/Matter of Balance – Macon

FAMILY SERVICE

- $167,141 for the following services by county:

- Senior Information Services/Options Counseling-Douglas

- Reducing Social Isolation-Champaign, Douglas

- Gerontological Counseling – Champaign

- Evidence Based/Healthy Aging Programs – Champaign

- Caregiver Advisor for Family Caregivers & Grandparents Raising Grandchildren – Piatt

CHELP

- $3,583 for the following services by county:

- Adult Protective Services Multidisciplinary Team/Training Support- Macon, DeWitt, McLean, and Livingston

VOLUNTEER SERVICE OF IROQUOIS COUNTY

- $83,914 for the following services by county:

- Senior Information Services/Options Counseling – Iroquois

LIFE CENTER

- $178,453 for the following services by county:

- Senior Information Services/Options Counseling – Clark & Cumberland

- Reducing Social Isolation- Clark & Cumberland

- Evidence Based/Matter of Balance – Clark & Cumberland

- Caregiver Advisor for Family Caregivers & Grandparents Raising Grandchildren- Clark & Cumberland

CHESTER P. SUTTON COMMUNITY CENTER OF EDGAR COUNTY

- $108,639 for the following services by county:

- Senior Information Services/Options Counseling - Edgar

- Caregiver Advisor for Family Caregivers & Grandparents Raising Grandchildren - Edgar

PIATT COUNTY SERVICES FOR SENIORS

- $52,568 for the following services by county:

- Senior Information Services/Options Counseling – Piatt

COLES COUNTY COUNCIL ON AGING

- $168,272 for the following services by county:

- Senior Information Services/Options Counseling – Coles

- Caregiver Advisor for Family Caregivers & Grandparents Raising Grandchildren – Coles

MID-ILLINOIS SERVICES FOR SENIORS

- $137,776 for the following services by county:

- Senior Information Services/Options Counseling – Moultrie

- Caregiver Advisor Services for Family Caregivers & Grandparents Raising Grandchildren – Douglas, Moultrie and Shelby

LAND OF LINCOLN LEGAL ASSISTANCE

- $75,388 for the following services by county:

- Legal Services – Champaign, Clark, Coles, Cumberland, DeWitt, Douglas, Edgar, Ford, Macon, Moultrie, Piatt, Shelby, and Vermilion

PRAIRIE STATE LEGAL SERVICES

- $26,663 for the following services by county:

- Legal Services – Iroquois, Livingston, and McLean

FORD COUNTY HEALTH DEPARTMENT

- $125,761 for the following services by county:

- Senior Information Services/Options Counseling – Ford

- Caregiver Advisor for Family Caregivers & Grandparents Raising Grandchildren – Ford

- Respite for Caregivers – Ford

- Adult Protective Services Multidisciplinary Team/Training Support – Ford & Iroquois

IROQUOIS COUNTY HEALTH DEPARTMENT

- $882 for the following service by county:

- Respite for Caregivers – Iroquois

The ARC

- $14,700 for the following service by county:

- Reducing Social Isolation – McLean

OSF PEACE MEAL NUTRITION PROGRAM

- $2,435,295 for the following service by county:

- Congregate and Home Delivered Meals – Champaign, DeWitt, Ford, Iroquois, Livingston, Piatt, and McLean

ECIAAA stands ready to support the Aging Network. Please do not hesitate in contacting us at 1-800-888-4456 with your questions. Thank you all for your dedication as we continue to support older adults, family caregivers, and grandparents raising grandchildren in East Central Illinois.

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Executive Director

DATE: October 5, 2022

RE: FY 2023 Older Americans Act Funding Update

According to USAging, Congress passed, and the President signed a short-term funding bill that prevents a government shutdown. This short-term funding bill, known as a continuing resolution (CR), will continue to fund the government at FY 2022 funding levels through December 16, 2022. This will allow Congress more time to negotiate a final FY 2023 spending bill after the November elections.

While the CR freezes most government spending at FY 2022 levels, the bill will also:

- Provide $1 billion for the Low Income Home Energy Assistance Program to assist families with the costs of heating and cooling, and to help mitigate the effects of rising energy costs and extreme weather.

- Authorize the U.S. Department of Transportation to extend the availability of funds awarded under its National Infrastructure Investment Grants program through FY 2023.

- Increase the cap on spending for the Social Security Administration’s administrative expenses to $13.6 billion, up from $13.2 billion.

- Provide $2 billion for HUD’s Community Development Block Grant to address unmet recovery needs in communities experiencing major disasters in 2021 and 2022.

- Extend funding through December 16, 2022 for the Temporary Assistance for Needy Families program.

As Congress proceeds with negotiations, we will continue to advocate for an increase in FY 2023 funding for Older Americans Act (OAA) programs. The President’s budget and proposed House Appropriations Committee’s budget include needed increases, especially for Title III-B Home and Community-Based Supportive Services. The Senate bill was less generous but still reflected an increase over FY 2022 levels for the OAA. Our next step is to advocate for a fully approved budget instead of relying on CR extensions. CRs will constrain OAA programs since FY 2022 funding was insufficient, and many states are beginning to deplete their infusion of COVID-19 relief funding.

ECIAAA stands ready to support the Aging Network. Please do not hesitate in contacting us at 1-800-888-4456 with your questions. Thank you all for your dedication as we continue to support older adults, family caregivers, and grandparents raising grandchildren in East Central Illinois.

To review these proposed allocations in a chart format, please click here to view USAging’ s appropriations chart.

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Executive Director

DATE: August 17, 2022

RE: FY 2023 Federal Funding Bills

The Senate Appropriations Committee released all 12 appropriates bills for FY 2023. Overall, the bills increase non-defense discretionary spending by 13.5 percent. Both the House and Senate bills will serve as a starting point for future negotiations. (Sources: USAging)

Older Americans Act (OAA) Proposed Allocations - Senate:

- $430 million, a proposed increase of $31 million (+8%) above the FY 2022-enacted level for OAA Title III BHome & Community-Based Supportive Services.

- $ 1 billion for OAATitle III C Nutrition Services, a proposed $64 million above the FY 2022-enacted level with $550 million (+3%) for congregate meals and $320 million (+10%) for home-delivered meals and $160 million (sustained funding level) for the Nutrition Services Incentive Program.

- $220 million, a proposed increase of $26 million (+13 percent) above the FY 2022-enacted level for OAATitle III E National Family Caregiver Support Program.

- $47.5 million, in sustained funding, for OAA Title VI Native American Nutrition, Supportive and Caregiver Services with Part A received $36.2 million, and Part C receiving $11.3 million.

- A total of $26.3 million, a proposed increase of $1.4 million (+6%) over FY 2022 levels for the for OAA Title III D Evidence-BasedHealth Promotion and Disease Prevention.

- $40 million, a proposed increase of $15 million (+61 percent) over FY 2022 levels for the OAA Title VII Long-Term Care Ombudsman Program.

Other Key Programs:

- $14 million, a proposed increase of $5.9 million (+73%) in funding under the Lifespan Respite Care Program to address existing gaps in respite care for older adults and people with disabilities.

- $239 million, a proposed increase of $9 million in funding for the three programs under the AmeriCorps Seniorsumbrella—RSVP, the Foster Grandparent Program, and the Senior Companion Program.

- $770 million, a proposed increase of $15 million above FY 2022-enacted levels for Community Services Block Grant. $1.7 billion in sustained funding for the Social Services Block Grant. The Low-Income Home Energy Assistance Program(LIHEAP) proposes nearly $200 million increase for discretionary funding of $4 billion.

- Proposed funding for Aging and Disability Resource Centers remains at $8 million.

- State Health Insurance Assistance Programs proposed level funding at $53.1 million.

To review these proposed allocations in a chart format, please click here to view USAging’ s appropriations chart.

Next Steps:

Our goal is to advocate for bipartisan support to maintain these proposed increases in OAA funding in the final appropriations bill. Please join me in that effort!

ECIAAA stands ready to support the Aging Network. Please do not hesitate in contacting us at 1-800-888-4456 with your questions. Thank you all for your dedication as we continue to support older adults, family caregivers, and grandparents raising grandchildren in East Central Illinois.

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Executive Director

DATE: March 11, 2022

RE: FY 2022 Appropriations Bill- Final Federal Budget

The U.S. Congress passed the FY 2022 omnibus appropriations package, known as the "Consolidated Appropriations Act, 2022" (H.R.2471), which is on its way to the President’s desk for his signature. The $1.5 trillion spending package will fund the government for the remainder of the Fiscal Year (FY 2022) and provide emergency aid to Ukraine. Funding details are provided below. (Sources: USAging and Meals on Wheels America):

Older Americans Act (OAA):

- $398.5 million, an increase of $6 million (1.5 percent) above the FY 2021 enacted level for OAA Title III BHome & Community-Based Supportive Services.

- $967 million, an increase of $15 million (1.5 percent) above the FY 2021 enacted level for OAATitle III C Nutrition Services.

- $194 million, an increase of $5 million (2.6 percent) above the FY 2021 enacted level for OAATitle III E National Family Caregiver Support Program.

- $47.5 million, an overall increase of $1.5 million (3.2 percent) above FY 2021 enacted level, for OAA Title VI Native American Nutrition, Supportive and Caregiver Services. Part A received a $1 million increase for a total of $36.2 million and Part C received $500 thousand for a total of $11.3 million, respectively.

- Level funding at $24.8 million for OAA Title III D Evidence-BasedHealth Promotion and Disease Prevention.

- $24.6 million, an increase of $1 million (4.2 percent) over FY 2021 levels for the OAA Title VII Long-Term Care Ombudsman Program.

Other Key Programs:

- Lifespan Respite Carereceived an increase of $1 million (14 percent) for a total of $8.1 million to address existing gaps in respite care for older adults and people with disabilities.

- $231 million, an increase of $6 million (2.7 percent) in funding for the three programs under the AmeriCorps Seniorsumbrella—RSVP, the Foster Grandparent Program, and the Senior Companion Program.

- $405 million for the Senior Community Service Employment Program (Title V of the Older Americans Act), which is level funding.

- $4 million for the Community Care Corps grant program within funding for Aging Network Support Activities.

- The Community Services Block Grant received a $10 million increase (1.3 percent) above FY 2021 levels for a total of $755 million, while the Social Services Block Grant received identical funding at $1.7 billion. The Low-Income Home Energy Assistance Program(LIHEAP) level reflected a $50 million increase for discretionary funding of $3.8 billion.

- Funding for Aging and Disability Resource Centers remains at $8 million.

- State Health Insurance Assistance Programs received an additional $1 million (1.9 percent) over FY 2021 levels for a total of $53 million.

- The bill also encourages ACL to coordinate with the Department of Labor to identify and reduce barriers to entry for a diverse and high-quality direct care workforce, and to explore new strategies for the recruitment, retention and advancement opportunities needed to attract or retain direct care workers.

- The bill provides $1 billion to the Section 202 Housing for the Elderly program, an increase of $178 million from FY 2021 enacted levels.

- Funding levels remain stagnant at $7.5 million in technical assistance and training activities for the Federal Transit Administration, the funding source for the USAging and Easterseals-led National Aging and Disability Transportation Center (NADTC). NADTC assists local communities and states in the expansion and provision of transportation services for older adults and people with disabilities.

Next Steps:

ECIAAA will continue to advocate for increased Older Americans Act funding to sustain services to growing aging population in East Central Illinois. Please refer to USAging’s Appropriations Chart updated March 10, 2022.

The final bill reflects significant reductions to what was contained in the President’s FY22 budget request, and in House and Senate proposed Older Americans Act appropriation levels. ECIAAA stands ready to support the Aging Network. Please do not hesitate in contacting us at 1-800-888-4456 with your questions. Thank you all for your dedication as we continue to support older adults, family caregivers, and grandparents raising grandchildren in East Central Illinois.

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Executive Director

DATE: February 11, 2022

RE: FY 2023 Governor Pritzker’s Proposed Budget – Illinois Aging Budget

On February 2, 2022, Governor J.B. Pritzker submitted the FY 2023 Illinois operating budget the members of the General Assembly and people of the State of Illinois. The $45.4 billion operating budget for the fiscal year that begins July 1st represents a 3.4% decrease when compared to the FY 2022 budget estimates. Proposed reductions in operating budgets of State Agencies due to reduced travel and improved efficiencies have also been factored in the introduced FY 2023 budget.

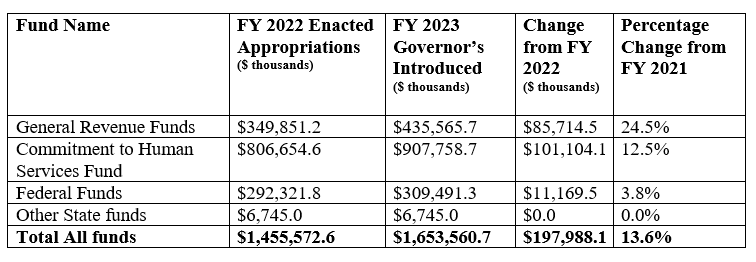

FY 2023 Introduced Budget Illinois Department on Aging (IDoA) – Total increase of 13.6%:

FY 2023 Introduced Budget – Illinois Department on Aging Budget Highlights:

Program Highlights

- Home Delivered Meals (HDMs): $14.2 M increase to meet the increased demands for HDMs as a result of the pandemic. The increase will allow Area Agencies on Aging:

- Expand the provision of cultural/ethnic meals

- Add medically tailored meals

- Provide two meals per day for older adults determined to be at high nutritional risk

- Expand partnerships with non-traditional meal providers, including restaurants and hospitals

- Caregiver Support: An increase of $4 M to Area Agencies on Aging to strengthen services to caregivers in Illinois. One of the greatest benefits of these services is to reduce social isolation among older adults and enhance support for family caregivers to avoid burnout and premature placement in a long-term care facility.

- $1 M to sustain Reducing Social Isolation among Older Adults Initiatives launched by Area Agencies on Aging (AAAs) during FY 2020, FY 2021, and FY 2022.

- $ 1 M to sustain Alzheimer’s Disease and Related Dementias programming launched by AAAs during FY 2022.

- $ 9.2 M increase to support the Illinois Adult Protective Services Program.

- $ 3.6 M Senior Health Assistance Program (SHAP) sustained funding.

- $ 2.3 M increase to support the Long-Term Care Ombudsman Program.

- Community Care Program. An increase of $14.2 M to fund rate increases for Community Care Program providers beginning January 1, 2023.

FY 2023 Budget Action by the Illinois General Assembly – April 8, 2022.

Illinois lawmakers will take on the review and approval of a final FY 2023 budget during the final spring session of the 102nd Illinois General Assembly. The General Assembly instituted an abbreviated schedule this spring with final budget appropriations expected by April 8, 2022. We will keep you posted!

ECIAAA stands ready to support the Aging Network. Please do not hesitate in contacting us at

1-800-888-4456 with your questions. Thank you all for your dedication as we continue to support older adults, family caregivers, and grandparents raising grandchildren in east central Illinois.

SCR:sr

Enclosures: IDOA FY 2023 Introduced Budget Presentation

IDOA FY 2023 Detailed Budget Pages

ECIAAA EXECUTIVE DIRECTOR’S REPORT

TO: ECIAAA CORPORATE BOARD, ADVISORY COUNCIL MEMBERS, & ECIAAA SERVICE PROVIDERS

FROM: Susan C. Real, Executive Director

DATE: December 9, 2021

RE: FY2022 OAA Funding Update

According to Meals on Wheels America, on December 2nd, Congress passed H.R. 6119, the Further Extending Government Funding Act, by votes of 221-212 in the House of Representatives and 69-28 in the Senate. H.R. 6119 is a continuing resolution (CR) – or short-term spending bill – that would extend current federal funding levels until February 18, 2022. As a reminder, federal funding for Fiscal Year (FY) 2022 has not yet been finalized, and this is the second CR that Congress has needed to pass to prevent a government shutdown and keep federal agencies and programs operating. This latest CR will temporarily extend FY 2021 funding levels for another 11 weeks, giving Congress more time to complete spending negotiations and pass all 12 outstanding annual appropriations bills.

As Congress proceeds with its negotiations, we continue to advocate for an increase in FY 2022 funding for the Older Americans Act (OAA) programs. We are also urging Congress to pass and the President to sign into law all FY 2022 appropriations bills before this second CR expires on February 18. As CRs only extend current appropriations levels, they do not allow for the annual funding increases that are essential to the senior nutrition network, especially as your reach to help older adults has further expanded during the pandemic.

East Central Illinois Area Agency on Aging Announces

FINAL Grant Awards for FY 2022

BLOOMINGTON – The East Central Illinois Area Agency on Aging (ECIAAA) announces the Older Americans Act (OAA) and Illinois General Revenue Fund (GRF) awards for FY 2022. Funding supports programs that help over 23,000 vulnerable older adults live with independence and dignity in their homes and communities in East Central Illinois. A total of $6,764,118 in OAA/GRF funding was awarded to the following community-based organizations in the counties of Champaign, Clark, Coles, Cumberland, DeWitt, Douglas, Edgar, Ford, Iroquois, Livingston, McLean, Macon, Moultrie, Piatt, Shelby and Vermilion.

SARAH BUSH LINCOLN MEDICAL CENTER- PEACE MEAL NUTRITION PROGRAM - $1,103,039 for the following services by county:

Congregate and Home Delivered Meals Service Area: Counties of Clark, Coles, Cumberland, Douglas, Edgar, Moultrie and Shelby

CRIS HEALTHY-AGING CENTER - $977,839 for the following services by county:

Coordinated Point of Entry/Senior Information Services/Options Counseling – Champaign & Vermilion

Reducing Social Isolation- Champaign & Vermilion

Congregate & Home Delivered Meals – Vermilion & Champaign

Evidence Based/Healthy Aging Programs – Champaign & Vermillion

Caregiver Advisor for Family Caregivers & Grandparents Raising Grandchildren - Champaign & Vermilion

Respite for Family Caregivers – Vermilion

Adult Protective Services Multidisciplinary & Training Support – Vermilion

STARTING POINT/MACON COUNTY HEALTH DEPARTMENT - $215,390 for the following services:

Coordinated Point of Entry/Senior Information Services/Options Counseling – Macon. NOTE: Includes CPoE/SIS Consortium Partners - CHELP & Decatur-Macon County Senior Center.

Reducing Social Isolation- Macon

Caregiver Advisor for Family Caregivers & Grandparents Raising Grandchildren – Macon

Respite for Family Caregivers – Macon

LIVINGSTON COUNTY HEALTH DEPARTMENT - $833 for Respite Services for Caregivers